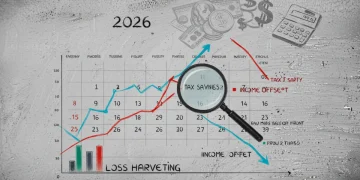

2026 Tax Loss Harvesting: Offset $3,000 Ordinary Income Annually

Leveraging 2026 Tax Loss Harvesting allows investors to strategically sell investments at a loss to offset capital gains and up to $3,000 of ordinary income annually, presenting a time-sensitive opportunity for significant tax savings.

Federal Grants 2026: Your Guide to 100+ Funding Opportunities

This guide provides a comprehensive overview of how to effectively identify and apply for over 100 federal grant opportunities anticipated for 2026, offering practical solutions and time-sensitive strategies.

Apprenticeships vs. Degrees: 2026 US Career Cost-Benefit

For US career starters in 2026, choosing between an apprenticeship and a traditional degree involves a critical cost-benefit analysis, weighing immediate earnings and practical skills against long-term academic benefits and potential debt.

Maximizing Education ROI: Earn Back Tuition by 2029

Achieving a strong return on investment for your education by earning back tuition costs within three years post-graduation in 2029 requires strategic academic choices, proactive career planning, and diligent financial management.

Healthcare Reform 2026: 4 Major ACA Changes Explained

The 2026 National Healthcare Reform introduces significant changes to Affordable Care Act provisions, aiming to enhance accessibility, affordability, and equity across the American healthcare landscape.

Veterans’ Benefits 2026: New Programs & Financial Advantages

This article provides a comprehensive analysis of new veterans' benefits programs in 2026, detailing their financial advantages and the significant impact they will have on service members and their families, offering crucial insights for future planning.